Get up to $250 to Rebuild Your Credit

Getting a guaranteed approval line of credit in Canada has never been easier.

Guaranteed Approval Line of Credit in Canada

A line of credit from Nyble is a flexible loan arrangement that allows you to borrow funds up to a predetermined limit as needed. You can draw from the credit line, repay, and borrow again over the agreed period, making it a versatile financing option.

By removing traditional barriers like credit score requirements and leveraging automation, Nyble provides a fast, accessible solution for Canadians facing urgent financial needs.

Simplified Application Process:

Nyble has streamlined its application process to be user-friendly and fast. Instead of lengthy forms and extensive paperwork, users typically complete a short online application, often just a few minutes. This rapid process is crucial in emergencies when immediate access to funds is needed.No Credit Check Requirement:

One of Nyble’s key features is that it does not rely heavily on traditional credit checks. Many lenders evaluate credit scores to determine eligibility, which can be a barrier for those with bad credit. Nyble bypasses this step or uses alternative methods to assess creditworthiness, making it accessible to a broader range of CanadiansInstant Approval and Disbursement:

Thanks to automation and integration with banking systems, Nyble can often approve applications instantly. Once approved, the funds are disbursed quickly—sometimes within minutes—directly into the applicant’s bank account. This rapid turnaround is essential for urgent financial needs.-

Accessible 24/7:

Many of Nyble’s services are available around the clock, allowing Canadians to apply at any time. This accessibility means users can get funds instantly, regardless of the time or day, which is especially helpful during emergencies. Apply for a guaranteed line of credit in Canada now.

Nyble offers a compelling opportunity for consumers to access funds without incurring interest charges, specifically guaranteeing a $250 credit with a 0% interest rate. This bold promise is made possible through a combination of strategic financial partnerships, innovative lending practices, and promotional incentives designed to attract new users.

Strategic Partnerships and Promotional Offers

Nyble collaborates with financial institutions and credit providers that support promotional financing options. These partnerships enable Nyble to offer initial interest-free periods on certain credit lines, including a guaranteed $250. Typically, these offers are part of introductory promotions aimed at onboarding new customers, allowing them to borrow money without paying interest for a specified period—often 30 to 90 days.

Risk Management and Credit Assessment

To ensure the guarantee remains viable, Nyble employs advanced credit assessment tools. These tools evaluate users’ creditworthiness quickly and accurately, minimizing the risk of default. By focusing on responsible lending and working with consumers who have a good credit profile, Nyble reduces the likelihood of losses, making the interest-free guarantee sustainable.

Transparent Terms and Conditions

Nyble clearly communicates that the $250 guarantee is subject to specific terms, such as timely repayment within the interest-free period. If the borrower repays the amount in full before the interest period ends, they owe nothing beyond the principal—hence, the 0% interest. This transparency encourages responsible borrowing and ensures consumers understand their obligations.

Promotional Incentives and Loyalty Programs

To further solidify the guarantee, Nyble often runs promotional campaigns where the initial $250 credit is offered as a limited-time incentive for new users. These campaigns may include referral bonuses or loyalty rewards, which subsidize the cost of offering interest-free credit. Over time, as users establish a history of responsible repayment, Nyble builds trust and encourages continued use of their financial products.

Operational Efficiency and Technology

Nyble leverages cutting-edge technology, such as automated credit scoring and real-time risk evaluation, to swiftly approve credit lines and ensure that users can access $250 with confidence. This efficiency allows them to confidently offer interest-free credit, knowing that they can monitor and manage repayment behaviors effectively.

Applying for a Nyble line of credit is designed to be a straightforward, user-friendly process that can be completed entirely online. Whether you’re seeking a small credit boost or a flexible financial solution, Nyble’s application process ensures quick approval and transparent terms.

Step 1: Visit the Nyble Website or App

Begin by visiting Nyble’s official website or downloading their mobile app from your device’s app store. The platform is optimized for both desktop and mobile use, providing easy navigation and access to all features.

Step 2: Create an Account

To apply for a line of credit, you need to create a secure account. This involves providing basic personal information such as your name, email address, phone number, and creating a password. You may also be asked to verify your identity through email or phone verification to ensure account security.

Step 3: Complete the Application Form

Once your account is set up, navigate to the application section. You’ll be asked to provide details about your financial situation, including your employment status, income, monthly expenses, and existing debts. Providing accurate information is crucial for an approved application and favorable credit terms.

Step 4: Submit Necessary Documentation

Nyble may request supporting documents to verify your financial information. These can include recent pay stubs, bank statements, or identification documents like a driver’s license or passport. Upload these securely through the platform’s document submission feature.

Step 5: Credit Assessment and Approval

After submitting your application, Nyble’s automated systems analyze your creditworthiness based on your provided data and credit history. This process typically takes a few minutes to a few hours. If approved, you’ll receive the terms of your line of credit, including the credit limit, interest rate (if applicable after promotional periods), and repayment schedule.

Step 6: Review and Accept Terms

Carefully review the loan agreement, paying close attention to repayment terms, fees, and any promotional offers like 0% interest for an initial period. If you agree, accept the terms electronically to activate your line of credit.

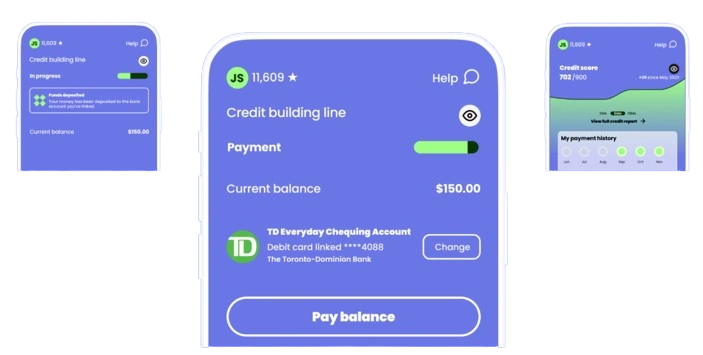

Step 7: Access Funds and Manage Your Account

Once approved, you can draw funds from your line of credit as needed through the Nyble platform. You can also set up automatic payments or manually make repayments to manage your debt effectively.

Additional Tips

- Keep your personal and financial information updated to maintain good standing.

- Use the platform’s tools to monitor your credit utilization and repayment progress.

- Take advantage of promotional offers responsibly to avoid unnecessary charges once the interest-free period ends.