Even with bad credit, you can access $250 instantly with KOHO. Everyone is approved.

Get started today and enjoy a free $20 Sign-up bonus

No hidden fees, no fine print, no catch — just the ultimate way to spend and save.

Get a $250 MasterCard from KOHO with Bad Credit

Introduction to Koho

Koho is the ultimate quick and easy credit building app designed to help you achieve your financial goals effortlessly. One of its standout features is that all new members receive a $250 starter loan, regardless of their current credit score. This allows you to start building or improving your credit immediately, without any prior credit history or score requirements.

User-Friendly Platform and Features

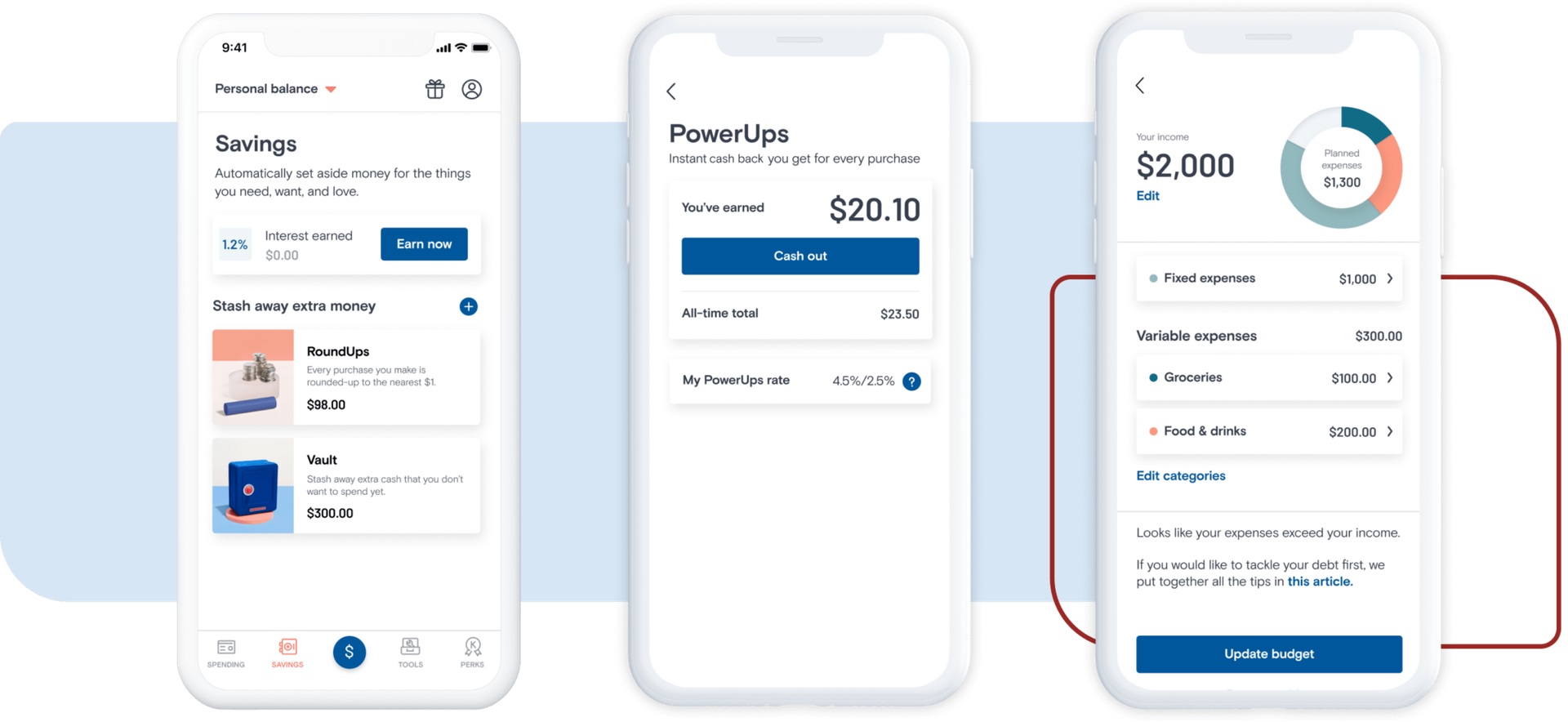

Koho’s user-friendly platform makes managing your finances simple and accessible. With just a few taps, you can monitor your spending, set savings goals, and track your progress—all designed to boost your credit profile over time. The app offers instant account setup, so you don’t have to wait days or weeks to get started. Its streamlined process ensures you can begin building your credit right away, with minimal effort and maximum convenience.

Benefits for Credit Building and Financial Control

Whether you’re new to credit or looking to improve your score quickly, Koho provides a straightforward solution that empowers you to take control of your financial future. The $250 starting bonus acts as a helpful boost, giving you the resources to start demonstrating responsible credit behavior immediately. With Koho, building good credit is quick, easy, and accessible for everyone.

About Koho

Koho is a Canadian financial technology company that offers innovative banking solutions designed to help users manage their money effectively while building or improving their credit profiles. One of Koho’s key features is its focus on credit building, making it an attractive option for individuals looking to establish or enhance their credit history without the traditional hurdles associated with secured loans or credit cards.

How Koho Supports Credit Building

Koho’s approach to credit building revolves around its prepaid Visa card, which is linked to a Koho spending account. Unlike traditional credit cards, the Koho card is a reloadable prepaid card, meaning users load funds onto their account before spending. This setup provides a way to manage spending responsibly while demonstrating financial discipline, an essential factor in credit scoring models.

To support credit building, Koho integrates with credit bureaus, reporting user activity and responsible spending behavior. When users consistently pay their bills on time and maintain low balances, these positive behaviors are reported to credit bureaus, helping to establish or improve credit scores. This method is particularly beneficial for those with no prior credit history or those rebuilding credit after past financial setbacks.

Additional Features and Accessibility

Koho also offers features such as savings goals, budgeting tools, and cashback rewards, which encourage responsible financial habits. By promoting consistent, responsible use of their prepaid card, users can gradually build a positive credit history, opening doors to traditional credit products like loans and mortgages in the future.

Another advantage of Koho’s credit-building platform is its transparency and accessibility. Unlike traditional credit cards, which often require good or excellent credit scores to qualify, Koho’s prepaid card can be obtained without a credit check. This makes it accessible to a broader audience, including young adults, newcomers to Canada, or individuals with poor credit who want to rebuild.

Accessible Credit Line Without Secured Funds

One of the most appealing features of Koho’s credit-building offerings is the ability to access a $250 credit line without the need for secured funds or collateral. Traditional credit cards often require security deposits or collateral, which can be a barrier for many potential users, especially those with limited or poor credit history. Koho’s innovative approach provides an alternative that is both accessible and straightforward.

Basis for the $250 Credit Line Guarantee

Koho’s guarantee of a $250 credit line is rooted in its partnership with credit bureaus and its emphasis on responsible financial behavior. Instead of requiring users to deposit funds upfront, Koho assesses eligibility based on other factors, such as income, employment status, and overall financial habits. Once approved, users are granted a $250 credit limit, which they can access through the Koho Mastercard.

Risk Management and Responsible Lending

The key to this guarantee lies in Koho’s risk management and commitment to responsible lending. The company uses advanced algorithms and credit reporting to evaluate user behavior. By encouraging consistent on-time payments, low utilization ratios, and responsible spending, Koho minimizes risk while providing users with access to credit.

Promoting Financial Discipline and Trust

Moreover, Koho’s model is designed to foster trust and positive habits. Since the credit line is not secured by deposits, users are motivated to manage their account responsibly to avoid exceeding their limit or incurring fees. This approach benefits both the user and Koho, as it promotes financial discipline and reduces default risk.

Supporting Financial Education and Credit Growth

Another factor enabling this guarantee is Koho’s focus on financial education and support. The platform provides tools and insights to help users understand their spending patterns and improve their credit behavior over time. As users demonstrate responsible activity, their creditworthiness improves, potentially enabling increases in their credit limit or access to other financial products.

Strategic Approach to Credit Building

In essence, Koho’s guarantee of a $250 credit line without secured funds is a strategic combination of responsible lending, credit reporting, and behavioral incentives. It lowers the entry barrier for individuals seeking to build credit, empowering them to establish a positive credit history without the need for collateral or large deposits. This innovative approach aligns with Koho’s mission to make financial services accessible and promote responsible financial management.

Applying for a Koho Mastercard, especially one that is guaranteed or linked to credit-building features, is a simple and straightforward process designed to be accessible for most users. Here are the key steps to follow:

-

Create a Koho Account:

The first step is to sign up for a Koho account. Visit the Koho website or download the Koho app from the App Store or Google Play. The registration process involves providing basic personal information such as your name, address, date of birth, and contact details. Koho may also ask for your employment and income information to assess eligibility. Complete the Identity Verification:

As part of regulatory compliance, Koho requires identity verification. This might involve submitting a government-issued ID, such as a driver’s license or passport, and sometimes a selfie for verification purposes. This step ensures the security of your account and confirms your identity.Apply for the Card:

Once your account is set up and verified, you can request a Koho Mastercard through the app or website. The application process is typically quick, and Koho may perform a soft credit check or none at all, depending on the product. For credit-building cards or guaranteed credit lines, approval is often based on your overall financial profile and responsible behavior rather than credit score alone.Wait for Approval:

After submitting your application, Koho reviews your information. Since Koho emphasizes accessibility, many applicants are approved quickly. If approved, you will receive your Mastercard in the mail within a few business days. You can also activate the card through the app or website.Fund Your Account and Use Your Card:

Once your card arrives, you can load funds onto your Koho account via bank transfer or other methods supported by the platform. You can then use your Koho Mastercard for everyday purchases, online shopping, and bill payments.Build Credit and Monitor Your Progress:

As you use your Koho Mastercard responsibly—making timely payments, keeping balances low, and maintaining good financial habits—your credit profile is positively impacted. Koho provides tools to monitor your credit progress and offers tips to improve your creditworthiness over time.